Students are leaving college with record-breaking levels of debt, the only consumer debt on the rise since the recession. Due to the staggering levels of debt, recent graduates admit they have delayed plans to buy cars, houses or even get married.

According to a 2013 Huffington Post article, student loan debt passed the $1 trillion mark at the beginning of 2013, up from $550 billion at the beginning of the recession. This sum accounts for about 60 percent of the annual income of the class of 2011.

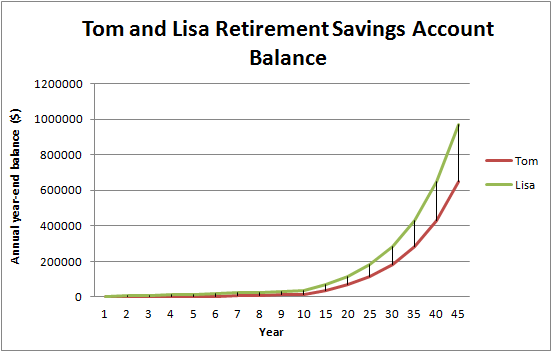

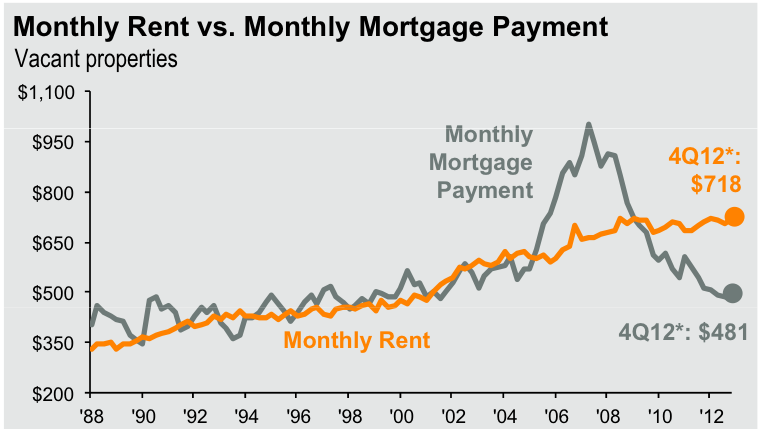

But as the chart shows, the average monthly mortgage payment is $237 less than the average monthly rent payment.

This is why it is important to know how to do a mortgage amortization.

An amortized loan is a loan where you figure out the monthly payment needed to make on both the principal, or original amount of the loan, as well as the monthly interest payment.

If recent grads knew how to amortize a mortgage, they would realize how much cheaper it can be to own a home than renting.

Let’s say a student graduates from Pacific Lutheran University with their bachelor’s in their chosen field and gets a job in the Tacoma area. Assuming the recent graduate wants a simple one-bedroom apartment, http://www.apartmentratings.com reports the average rent for Tacoma to be $912, nearly $200 more than the national average.

If the graduate looks at houses in the area, they will see that there are hundreds of houses for sale in the $100,000 – $200,000 range. Let’s say they want a nice little place so their taste in houses leads them to the $150,000 price tags.

If the recent grad has no savings and their parents cannot help out, they will need a loan for the full amount, or $150,000. This is the principal amount of the loan.

A common term for home loans is 30 years, and just last week the interest rate on a 30 year fixed rate loan hit 4.5 percent. Once all this information is figured out, they need to open up Microsoft Excel and figure out the monthly payment. If they don’t happen to have Excel already, there are many online calculators that can do the work for them such as this one from Bankrate.com.

In the first cell, put the $150,000 principal amount of the loan. In the second, goes either the annual interest rate, 4.5 percent, or save a step and make it a monthly rate by dividing by 12, which comes out to 0.375 percent. The last thing needed is the total number of months the loan is for. Simply multiply 30 years by 12 months to get 360.

The final step to calculating the monthly payment in Excel is entering these values into one of many premade equations in Excel. For any rookies out there, when doing calculations in Excel, simply go to an empty cell and start the entry with an equals sign.

In this case, following the equals sign, the recent graduate will be using the PMT function. So far the payment cell should look like this:

=PMT(

Now just plug in the values in the order that Excel asks for them, separated by commas. First is the monthly interest rate of 0.375 percent followed by the total number of months, 360. Next put the principal of the loan expressed as a negative number and then finally the future value of the loan, which is zero.

When all numbers are entered correctly, the final equation should look like this:

=PMT(0.375, 360, -150000, 0)

If the graduate understands how to use cell references they will get the same answer and have a more malleable value.

Then they simply hit enter to find that the monthly payment on a $150,000 home loan is only $760.03. That is about $152 cheaper than the average single-bedroom rental in the Tacoma area, $152 that can go toward dates so you can find that special someone who you want to share your wonderful new home with.

This will revolutionize the dating game, let me tell you. The person of interest will be so blown away you pay less per month to live in and own a house than they do to rent someone else’s, they will stick around simply to learn your financial secrets.