By Bjorn Slater, Business Editor

Credit can be a confusing concept for young people and falling into credit card debt early can be a vicious cycle. According to http://www.creditcards.com, only nine percent of students in 2012 had credit scores that were in that 700-850 range categorized as “very good” credit.

However, it also reports that 27 percent of college students have credit cards in their own name, meaning 66.7 percent of students with credit cards have sub-700 credit scores.

Many people are afraid to get credit cards because they are scared of missing payments and falling into credit card debt, but when used smartly they build a good credit score and history.

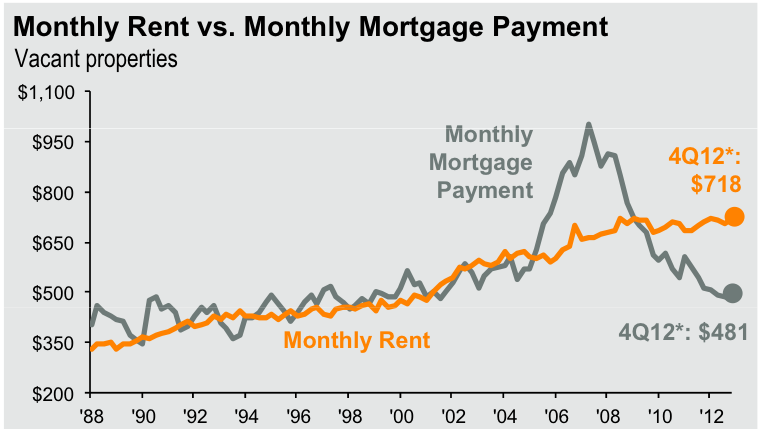

Future lenders, like for a home mortgage, will be willing to lend more money to people who have good credit. It shows they make payments on time and are statistically more likely to fulfill the terms of the loan.

It doesn’t have to be difficult. Building credit can be a safe and painless process as long as students follow these tips:

1. Figure out their credit score

Many students, 85 percent according to http://www.creditcards.com, do not even know their credit score. This is the first thing students need to figure out if they are considering a credit card as a person’s credit history is the first thing credit card issuers, or any lender, looks at. Everyone is eligible for a free credit report every year from each of the three major credit bureaus via http://www.annualcreditreport.com.

2. Credit cards should be for emergency use only

Nobody wants to pay interest on a stick of gum or a pair of socks, so it’s important to be smart about purchases on credit. Some credit cards give rewards if used for purchasing certain things. For example, according to http://www.americanexpress.com, a Costco TrueEarnings card earns three percent cash back at U.S. gas stations, one percent cash back at U.S. restaurants and one percent cash back on other purchases including anything at Costco.

This makes it easy to decide what kinds of things to put on credit, because the rewards are actually pretty decent, but not all credit cards make it so easy.

A general rule of thumb is that credit cards shouldn’t be used for everyday purchases. Obviously the Costco card is an exception, but generally credit shouldn’t be a substitute for things that students generally spend cash on. This habit can quickly lead to debt, so debit cards or cold, hard cash are the best option for ordinary items.

An appropriate time to use a credit card would be to help pay for textbooks. Let’s take a look at a theoretical biology student, Mary. She works a couple jobs to help pay for college and saves during the summer to help pay for books.

However, her last semester she finds out that she has made a terrible scheduling mistake and she needs to take three biology classes. She has $400 in her budget for textbooks but the total cost of all of her biology books is over $600 and she is worried that she won’t be able to afford all of them by the time classes start in a week.

But Mary forgot one important thing: she hasn’t maxed out her credit card on silly things like shamrock pajama pants. She is able to put one textbook on her credit card and pays off the charge once she gets paid at the end of the month.

This is just one example, but in the end it is up to each student to determine what an “appropriate” item is to purchase on credit. If students max out their credit cards every month, whether it is frivolous spending or not, it damages their credit score. Even if the balance is paid in full at the end of the month, 30 percent of what gets reported to credit bureaus are the amounts owed at the end of each month before repayment.

3. Pay the balance EVERY. SINGLE. MONTH.

Paying the balance is still incredibly important. As compared to the 30 percent of the credit score that is made up by the balance owed each month, 35 percent is made up by payment history. This is the most influential part of the credit score, if only by five percent. This makes it imperative that payments are on time and in full.

Creating a schedule for monthly bill payments is a great way to stay on top of things. Making payments up to a week in advance will ensure that they are processed on time and prevents any late payments from having a negative effect on students’ credit scores. If they own a smartphone, students can use the Google calendar app to automatically notify them each month before payments are due.

In the event that students aren’t able to pay the balance on their card at the end of the month, it isn’t the end of the world. Many credit card issuers are willing to provide a little wiggle room so long as they get a phone call ahead of time. In the end, they want to make sure they get their money while keeping customers happy.

As long as these tips are kept in mind, growing credit is not only possible, but pretty simple. Students who ensure that they don’t put unnecessary charges on their credit card and pay the balance every month are well on their way to establishing a good credit score and a healthy financial future for themselves.