Student loan debt is growing at an alarming rate, and it doesn’t show any signs of slowing down. The Federal Reserve Bank of New York reports that there is $902 billion in outstanding student loan debt in the U.S.

The Consumer Finance Protection Bureau reports the number is closer to $1 trillion. There are over 37 million people with outstanding student loan debt according the Federal Reserve Board of New York, which means the average debt per borrower is about $24,378.

About 65 percent of borrowers who are considered ‘high-debt’ borrowers misunderstood or were surprised by aspects of their student loans or the student loan process according to www.nera.com. To be considered a high-debt borrower one must have more than $25,000 in student loans, and this group is equal to about 25 percent of the 37 million total borrowers.

So, about 16 percent of people who take on student loans are going into five figures of debt without even knowing what they are getting into. It is imperative that students and their parents understand the terms of the loans they are getting into, because otherwise it can be easy to get in trouble.

According to www.asa.org, two out of every five student loan borrowers are delinquent, or late by more than 90 days, for a student loan payment within the first five years of entering their repayment period.

Delinquency can lead to default and defaulting on a loan can dramatically increase the balance owed, ruins credit scores and, in the case of federal loans, can allow the government to withhold tax returns or a percentage of a person’s wages.

Now that everyone is properly frightened, there is a light at the end of the tunnel: there are things students can do while still in school to make repaying their student loans easier when it comes time.

First, every student needs to know the grace period on their student loans. The grace period is how long they are allowed to wait after school until the first payment is due. Not all loans are created equal, and neither are the grace periods so it is important to keep track of which loans start repayment when.

Second, in the case of subsidized student loans, the government is paying the interest on the loans while a student is in school, but for all other loans the interest starts piling up when they are taken out and doesn’t wait for students to finish their education.

By simply multiplying the interest rate by the principal amount of the loan and dividing by 12, students can approximate the monthly interest accrued.

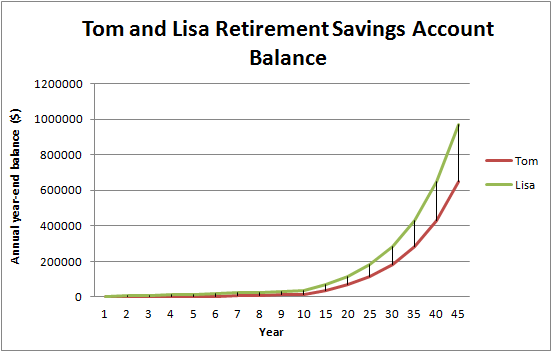

Student loans require repayment starting after school, but any need-based loans also let students start making payments while in school. The monthly interest accrued is a good minimum monthly payment while attending school because it prevents that interest being capitalized, or added to the original loan balance, upon graduation. When this happens, it increases the total balance owed on the loan which also happens to increase the monthly interest accrued.

Next, start lowering the principal on the loans as soon as possible. Whenever possible, students should try to make payments on the loan, because the sooner the balance starts getting repaid the less interest will need to be paid over the life of the loan.

If they can make payments above and beyond the monthly interest, they will be applied directly to the loan balance which reduces the amount of interest that accrues each month.

Finally, upon graduation, students should create a rough repayment schedule for the loan, otherwise known as a loan amortization. To learn more about loan amortization, check out my first Accounting for Dummies column online at https://mastmedia.plu.edu[WU1] . A schedule for every payment that needs to be made is a valuable resource that will prevent delinquency and default, those cruel destroyers of credit.

Student loans are an unfortunate, but necessary part of college students’ lives. They may seem scary, but the road to repayment can be a smooth one as long as students follow these simple tips.

[WU1]Breakout box.